Blog

Updates and insights on data ownership in the AI era — exploring how permission builds a safer, more transparent, and rewarding digital future.

Recent Articles

Permission’s $ASK Coin Listed on Gate.io Exchange

Permission is delighted to announce that the ASK digital currency will be listed on Gate.io, one of the top ten cryptocurrency exchanges globally with over ten million registered users. ASK will begin trading on Gate.io on February 17, 2022, with an ASK/USDT pairing.

The exchange offers spot, margin, futures and contract trading in addition to DeFi products through Hipo DeFi, custodial services through Wallet.io, investments through Gate Labs and its dedicated GateChain platform. Users can participate in a number of activities with ASK, including a liquidity mining rewards program where they can earn for providing liquidity for ASK.

“It has been an exciting year for the crypto industry, and we are looking forward to having ASK be more readily available to crypto enthusiasts globally through our partnership with Gate,” said Charlie Silver, CEO of Permission.io. “ASK is the currency of permission, and we look forward to expanding ASK’s visibility while continuing our mission to empower consumers to own and earn from their data.”

Global privacy regulations, ad blockers, and ever-changing ad tech trends are calling for a new and improved advertising model-one built on consent and value exchange. Permission.io enables a global tokenized ad system whereby consumers can securely grant permission and monetize their data across the web, and marketers can build loyalty and trust while achieving better return on their ad spend.

Permission Partners With Amasa

Permission is delighted to announce a new partnership with Amasa. Aligning with Permission’s mission to empower users to own and earn from their data, Amasa is a Web 3 and DeFi platform that enables users to capture and capitalize on the wealth-building potential of micro-income streams and DeFi.

In this collaboration, Amasa users will be able to combine their Permission income with other background streams, then amplify this combined value via DeFi. Permission and Amasa will collaborate on technical integration opportunities to maximize income potential for users, and Permission looks forward to expanding its network of like-minded projects through Amasa’s Web 3 platform.

“Partnering with Amasa is right in line with our shared vision of truly empowering people to own and earn from their data – this connection serves to speed up the process for consumers who are now producers in Web 3” says Bobby Petersen, Permission’s VP of Marketing.

About AmasaBy building the world’s first micro income stream investment app, Amasa is working to inspire mass adoption of Web 3.0 platforms that reward participants for their gaming, time, energy, attention, content, data and interactions.

What Is Staking Crypto and How Much Can You Earn?

While traditional finance solutions offer very low or even negative interest on their savings products, the crypto industry is always coming up with new ways to earn money.

In addition to investing and trading, the decentralized finance (DeFi) sector offers an excellent alternative to generating passive income through numerous ways, such as yield farming and cryptocurrency lending.

Today, we will introduce you to staking, a popular activity both in the DeFi and broader digital asset space. Staking crypto not only allows you to put your coins to work and earn rewards but also helps secure the networks of various blockchain solutions.

In this article, we will explore what crypto staking is, how it works, where to get started, as well as the potential risks and revenue you can generate with the activity.

What Is Crypto Staking?

Crypto staking refers to the activity in which a user locks coins in a wallet for a certain period of time to secure the network of a blockchain based on a Proof-of-Stake (PoS) consensus mechanism (or its variant, i.e., Delegated-Proof-of-Stake).

In terms of blockchain security, the network will choose a user who has staked his coins to validate the next block either randomly or by utilizing various factors (e.g., the amount of tokens staked).

In exchange for maintaining the ecosystem, users who stake their coins earn rewards, which is usually the combination of the cryptocurrency included in the block they validated and the fees associated with the transactions they processed for users.

What Is the Difference Between Crypto Staking and Mining?

It’s important to talk about the difference between crypto staking and mining. While both activities have the same purpose – to secure the network, generate new blocks, and validate transactions – they use two distinct approaches to achieve this goal.

Cryptocurrency mining is present mostly in Proof-of-Work (PoW) blockchain networks (e.g., Bitcoin), where validators (called miners) are required to leverage their computational power to solve complex mathematical puzzles to validate blocks.

For this, they purchase specialized hardware (e.g., ASICs and GPUs), which they operate continuously to compete with other miners to secure the reward for each block.

The higher the hash rate (computational power) in a PoW network is, the better it can protect against both internal and external threats, such as 51% attacks and malicious nodes.

As you can see, this is a rather energy-intensive process, which the PoW consensus algorithm has been long criticized for.

On the other hand, PoS blockchains do not require validators to utilize physical hardware or computational hardware to secure the blockchain. Instead, validators lock up their coins in their wallet via staking. Simply put, they guarantee the network’s safety with their money.

While this significantly reduces the energy consumption of the blockchain, staking is a similarly efficient mechanism in protecting users as mining blocks via the PoW algorithm.

In terms of investment, staking can be a more attractive method for users as it doesn’t feature the high upfront costs of mining (where you have to purchase the equipment first to get started) while providing a more predictable revenue stream (in a similar way as a savings account or a government bond).

Furthermore, staking has a well-established infrastructure within the crypto space. As a result, plenty of services offer an easy, flexible way for users to stake their coins. This contrasts with cryptocurrency mining, which requires miners to possess the technical knowledge and skills to maintain their equipment.

How Does Crypto Staking Work?

Now that you know the basics, let’s see how crypto staking works in practice.

First, it’s important to mention that staking is present in the crypto space in two different forms.

We have already taken a look at the first, where validators lock up their coins in their wallets to secure blockchain networks based on the PoS algorithm.

The process works as follows:

- A user deposits cryptocurrency into a supported wallet or staking service.

- The user selects the period (e.g., one month) he/she seeks to stake coins and utilizes the service to lock them up in his or her wallet. Alternatively, some solutions allow flexible staking, where users are free to withdraw their crypto holdings at any time without a mandatory lock-up time.

- After the lock-up period ends (or, in the case of flexible staking, the user is satisfied with the rewards), the staking provider releases the user’s coins and distributes the earnings after deducting the fees for providing the service (usually a percentage rate subtracted from the profits).

- The user is free to withdraw, spend, or re-stake the coins to generate more rewards.

The second type, called DeFi staking, is utilized not for safety purposes, but to offer a desirable user experience on certain decentralized exchanges (DEXs) that feature non-custodial atomic swaps between cryptocurrencies.

Unlike centralized exchanges, these DeFi solutions called automated market makers (AAMs) feature an entirely decentralized process for swapping coins. However, as they lack the order books of centrally-operated services, AAMs have to acquire liquidity from their users to facilitate efficient trading.

For that reason, they incentivize their users to supply both tokens of a trading pair at a 1:1 ratio in a liquidity pool. These rewards are usually offered in the platforms’ native coins after liquidity providers (LPs) have staked a special type of cryptocurrency called LP token.

LP tokens represent the users’ share in a liquidity pool, which they can redeem at any time for the tokens they supplied to the protocol along with their rewards.

By staking LP tokens, users lock the liquidity they provided to a specific platform for a certain period. Since this is a beneficial scenario for the service provider, it makes sense for the protocol to offer staking rewards for LPs.

Now let’s see an example for DeFi staking:

- A user connects his wallet to a DeFi AAM protocol and deposits DAI and ETH at a 1:1 ratio (1 ETH and $3,485 DAI based on October 11 prices) in the DAI/ETH liquidity pool.

- As the next step, the protocol issues the amount of DAI-ETH LP tokens that represent the user’s share in the pool and distributes them to his or her wallet.

- The user locks the DAI-ETH LP tokens on the protocol for 30 days to earn native token rewards from the service provider.

- After 30 days, the user redeems the DAI-ETH LP tokens for his or her original tokens as well as to claim any staking and liquidity provider rewards (e.g., a share of trading fees from the pool).

As you can see, no matter the staking type you choose, the process is similar in both cases and rather straightforward. And, while the mechanism is utilized to achieve different goals for the platforms, it serves the same purpose for stakers: to generate profits.

How Much Staking Rewards Can I Earn?

Besides its simplicity and lack of upfront costs, staking has become so popular in the cryptocurrency industry because it’s an excellent way for users to generate a passive income.

Staking rewards vary by the coin, which can range from anywhere from 1-2% to as high as 150% annually, especially if we take compound interest into account (when you maximize your gains by continuously re-staking or reinvesting your profits along with the principal sum).

In most cases, cryptocurrencies with larger market caps offer lower annual percentage yields (APYs) than smaller coins.

For example, while Ethereum (ETH) and Cardano (ADA) features 5-6% APYs, smaller-cap digital assets like DefiChain (DFI) or the Mirror Protocol (MIR) allow stakers to earn a yearly 70-75% after their coins.

Furthermore, rewards can also vary by the platform or service you utilize for staking. For example, while Binance and Everstake offer a 5.54% APY on ADA, some pools only feature a 3-4% ratio.

The reason for the variance in rewards may be due to two factors.

First, all of these services operate staking pools where they combine the locked coins of users to increase their chances to become validators and gain rewards.

At the same time, many PoS-based blockchains choose a validator for a block based on the amount of staked cryptocurrency. This means that the larger the pool, the greater chance it has to produce blocks and the better rewards it can generate for users.

Second, the commission service providers deduct from user profits can greatly impact one’s staking rewards. While some pools operate without fees, others charge 3-12%, and there are also platforms with extraordinarily high rates (30-50%).

For that reason, it’s crucial to research both the coins and the staking providers to generate the best staking rewards.

Is Staking Crypto Safe?

In general, crypto staking can be considered a safe activity within the digital asset space. However, it definitely comes with certain risks.

Unlike crypto lending, where lenders mostly earn revenue on stablecoins – digital assets pegged to one or a basket of other financial instruments (e.g., USD, EUR) to stabilize its price movements – staking predominantly involves locking up “standard,” non-stablecoin cryptocurrencies.

For that reason, the coins you dedicate to staking are subject to the high volatility associated with the cryptocurrency asset class (especially if you stake small-cap coins). As they can increase and decrease in value in short periods, this increases the risks of stakers.

These risks increase if you choose a staking service where users must lock up their coins for a specific period as you won’t be able to liquidate your crypto holdings in the case of a sudden market crash or another price movement (even if it’s favorable).

However, if you choose a flexible staking provider with no mandatory lock-up periods, you can mitigate your risks.

That said, volatility is not the only risk that comes with staking. For that reason, you should also be aware of the following factors:

- Counterparty risks: You can choose to stake your coins either on a centralized service where the provider stores your crypto holdings on your behalf or via a decentralized, non-custodial solution. If you choose the former, you should know that the platform is in custody of your private keys, which provide access to your coins. For that reason, you face increased risks of a loss in case of a successful hacker attack or an “internal” exit scam, unless the provider features the necessary security measures and guarantees.

- Smart contract bugs: If you stake coins as a liquidity provider on a DeFi protocol, you should be aware of the risks of smart contract bugs. Since these platforms use smart contracts to operate, a small issue in the code can lead to grave consequences for users. Therefore, you should always ensure that you use a reputable platform that features audited smart contracts.

- Slashing: Staking services handle all the technical parts of staking for you, including operating a blockchain node and validating blocks. However, suppose the provider is dishonest or fails to maintain a 100% uptime. In that case, some networks punish it by refusing to distribute rewards for a block or even slashing all its cryptocurrency stake. In the latter case, all users who have staked crypto via the service would lose their locked-up tokens.

Based on the above information, staking can be a high-risk activity. However, that is only true if you fail to do your own due diligence.

For example, you can significantly decrease your risks by staking your coins via a secure wallet through a reputable provider that features a long-standing history of continuous uptime and honest activity as part of a non-custodial solution.

Where to Start Staking Coins

Earlier on, we discussed the process you have to follow to stake your coins.

Now, you only need to choose the platform and method you will use to generate rewards after your cryptocurrency holdings.

For this, you can select between four different solutions:

- Cryptocurrency exchanges: Crypto exchanges provide one of the most convenient ways to stake crypto as you don’t have to move your holdings to other wallets or platforms to generate rewards. While this can come in handy when network transaction fees are high, this is a custodial solution that involves increased counterparty risks.

- Staking service providers:Like crypto exchanges, staking-as-a-service providers offer easy access to staking across numerous blockchains. However, these also involve custody over users’ funds.

- Crypto wallets: Many cryptocurrency wallet providers allow their users to stake their coins directly from their wallets without an intermediary. As a result, they don’t face the counterparty risks of custodial services while offering the same level of convenience (and similar reward rates).

- Manual staking: This is maybe the most complex method to start staking, which is a possibility for advanced users. Here, you operate your own node and stake your coins on your own. While this offers you the most freedom, it requires the necessary time and technical expertise to run your machine as well as a higher upfront investment for many blockchains (as there is usually a minimum amount validators have to meet).

It is also important to mention cold staking, where you generate a passive income via a wallet (e.g., a hardware wallet) that is not connected to the internet. For that reason, it’s probably one of the safest ways to earn revenue with the activity.

Staking: An Easy Way to Earn Rewards on Your Crypto Holdings

Crypto staking is a widely popular activity, where you can easily generate extra revenue on your digital assets without significant upfront investments.

As it only takes an initial deposit and a few clicks to get started, staking is a great way for both beginners and advanced crypto users to earn coin rewards.

At the same time, long-term investors can utilize staking to put the cryptocurrency they hold to work to maximize their profits.

In terms of risks, staking is generally a safe way to earn crypto. However, users must do their own due diligence as well as select reputable (ideally non-custodial) providers and coins with larger market capitalizations to minimize their risks.

Mastering Loyalty Programs: 6 Killer Options + Pro Advice

Stories of free flights, incredible deals, and “just used my points” are common these days. And for people who aren’t into loyalty programs, those who manage to travel so much on a low budget almost have this mystical aura about them. How do they do it? What do you mean she got a free flight and 4-star hotel for nothing?

Loyalty programs are designed to get you to come back to businesses, and they can be cumbersome and draining if you’re in too many or don’t choose the right ones, but if you know how to play the game, you can save yourself thousands of dollars on purchases you would have made anyway.

One of the keys to winning in loyalty programs is staying on top of the latest offers and loyalty programs. And while points and cash back programs have dominated the space for years, we’re going to show you how to both make the most of existing loyalty programs and show you what the future of loyalty programs looks like — that way you can stay on top of things.

Let’s go!

Common Types of Loyalty Programs

Since loyalty programs are any sort of program that rewards customers for purchases, consistency, engagement, referrals, etc. There are a lot of types.

Here are a few of the most popular:

- Points programs like credit card or hotel points

- Subscription programs like unlimited monthly coffee, Regal Unlimited, or Amazon Prime

- Referral programs like The Hustle’s referral system

- Tier-based programs like Chick-fil-A

- Cashback programs like Capital One’s Quicksilver Cash Rewards Credit Card

- Perks programs like Kroger’s gas discount

- And many more!

There is an abundance of loyalty programs these days. So the trick isn’t finding them, it’s deciding which ones to use.

Why Should You Join Loyalty Programs?

When used correctly, loyalty programs save (or give) you more money than you would have had without them.

For example, if you spend $500 a month on groceries, have a credit card that gives you 2 points (worth a cent each) for every dollar spent, and pay off your credit card in full each month, you would get an automatic $10 back each month for doing exactly what you do anyway.

Or take credit card bonus fees. If you’ve been saving up for a new entertainment system that costs around $3,000, and instead of paying cash you signed up for a new credit card that had a “sign-up offer” that gives you $600 in points after spending $3,000 in the first two months, you could get $600 back on a purchase you were already going to make.

By optimizing your spending around the highest value programs whose points or rewards can be used on purchases you were already going to make anyway and strategically utilizing sign-up bonuses, you can save thousands of dollars over a few years, pay for flights, get free hotel rooms, and more.

It takes a bit of work to get set up and switch at the right times, but it’s still well worth the effort you put in.

The 6 Best Loyalty Programs You Should Consider Joining

Again, loyalty programs are designed to get you to spend more, but if you’re aware of that fact, you don’t have to.

By only joining programs that directly impact your existing spending, you can minimize the temptation to overspend / nullify the value of your rewards.

With that in mind, here are some of the best loyalty programs out there. We’ve included a diverse list — that way you could feasibly make a good decision by just going with all of these. These options are more useful when starting out than 5 different airline programs, for example.

Note: These are based off of NerdWallet’s 2021 Winners, personal experience, and other misc. research. The program details below were accurate at the time of the writing but may not remain the same.

Alaska Airlines Mileage Plan

Ideal for casual domestic flyers who like to take one other person on their trips.

While you won’t be able to fly anywhere, anytime, the rewards system of Alaska Airlines is fantastic. If you make $2,000 of purchases within 90 days, you get 40,000 bonus miles (around $440) and the Annual Companion Fare, which can drop a ticket for a friend down to $99 + fees. Add in rewards based on miles instead of cash and 3x miles for all Alaska Airlines bookings, and you can see why people love this loyalty program.

Reward Currency: Alaska Miles

Key Aspects:

- Reward based on miles flown instead of cash spent, which rewards smarter booking choices

- Can transfer points to Emirates and Cathay Pacific and other partners to 1,000+ destinations

- $75 annual fee

- 3 miles for every $1 on Alaska Airlines flights, 1 mile for $1 for all other purchases

- Free checked bags for up to 6 guests on the same reservation

- No foreign transaction fees

Amazon Prime

Best for frequent online shoppers who want quick deliveries.

You may not think about Amazon Prime as a loyalty program, but that’s because it is so good at what it does that it escapes the label. Amazon does everything they can to make you lose money by not being a part of Prime (assuming you shop at Amazon regularly).

From Prime video, to free shipping, to lower prices in Amazon, using Amazon and not having Prime doesn’t make any sense, and that’s the point.

Reward Currency: None

Key Aspects:

- Free two-day shipping on Prime eligible items

- Prime discounts

- Early access to deals

- Prime video streaming

- Pay monthly at $12.99 or yearly at $119

Chick-fil-A

Good for anyone who eats Chick-fil-A more than 2x a month.

Chick-fil-A, regardless of your opinion of fast food and their enterprise, is a brilliant business. They are superb at cleanliness, timeliness, consistency, and rewarding their customers.

Their loyalty program is legendary and has some really clever mechanisms to keep you coming back. So if you get down with Chick-fil-A at least more than 2x per month, then check it out.

Reward Currency: Points

Key Aspects:

- Three Tiers: Member, Silver Member, Red Member

- Points are rewarded for cash spent

- Birthday rewards

- Has giveaways for downloading the app and signing in consistently

- Mobile ordering through app makes pick-up easier

- Higher levels let you give away your gifts to others

- The higher level you are, the more points you earn per $1

- Higher levels have more say on the menu items Chick-fil-A releases

Capital One Venture Rewards Credit Card

A good “jack-of-all-trades” travel card for people who tend to fly on different airlines and use different hotels.

Capital One’s Venture Rewards Credit Card has been a big player in the credit card points game for a bit. The points are easy to earn and use, and you can transfer or spend your points on just about anything.

Reward Currency: Miles

Key Aspects:

- 60,000 mile bonus after spending $3,000 in the first month (~ $600 value)

- 2 miles per dollar spent on anything and everything

- $95 annual fee

- Best value when you redeem for travel

Permission

Good for anyone who wants to get paid for doing what they already do on the web.

Here’s the deal. Almost everything you do on the internet involves and leaves data, but since the dawn of the internet, YOU haven’t been paid for the use of your data. Meanwhile, huge internet companies have made massive fortunes off of your information.

Permission prescribes to a simple but radical idea: shouldn’t you get paid for your data?

And the best part? You don’t have to change any of your habits. You join Permission, and companies reward you with crypto in return for your time and attention. It’s that simple.

Reward Currency: ASK

Key Aspects:

- A new type of loyalty program driven by crypto rewards

- A browser extension that lets you earn crypto based on your existing searches and habits

- Earn crypto for engaging with ads and content

- Is expanding its reach to become the backbone of loyalty programs everywhere everywhere, making it easier and more flexible for earners to redeem across brands.

Start earning from your data (for free)

Regal Unlimited

Great for any movie buffs who see more than 2 movies a month.

This is Regal’s answer to the spectacular fall of MoviePass. For ~$20/month you can watch as many movies as you’d like and earn on concession purchases. Since movies cost between $12-15 these days, if you go to at least two movies a month, you’ll be saving money.

Reward Currency: Crown Club Credits

Key Aspects:

- Different tiers open up more and more theaters, but the middle tier for $20/month is usually more than enough.

- Earn credits on all purchases that can be redeemed for free tickets and food. Pay for your friends’ tickets to rack up points!

- Unlimited movies per month, including new releases.

- Fees can apply for booking less than an hour in advance.

How to be a Loyalty Program Pro

Here are some tricks of the trade from loyalty program pros.

Make sure the annual fees make sense for your spending.

If you aren’t going to earn more in points than the annual fee, don’t go for it. That would just mean more unnecessary bills. It’s easiest to get hit by unnecessary annual fees when you have a lot of cards, so make sure whichever ones you have you’re actually using!

Note many credit card companies will cancel or reduce your fee if you call them to cancel shortly after noticing an annual fee charge.

Ditch the cash.

The more you spend on your card, the more points you earn. Cash should become a last resort — it’s a pointless transaction!

Maximize your earnings by choosing which card to spend with on particular categories.

Some cards earn you more on food. Other more on flights. Know which cards are best spent where so you can maximize your earnings.

Choose loyalty programs that fit into your existing habits

The point of loyalty programs is to get you to spend more, but you can outwit them by only choosing cards that complement your existing spending habits. If you already fly multiple times a year, there’s no reason not to earn from them, but if you don’t already shop at Nordstrom, maybe you don’t need their card.

Get your credit score to above 720

Most loyalty programs and good credit cards with rewards require decent credit. If you aren’t above 720 yet, put the time and work in to get there before going down the loyalty program rabbit hole.

Do not go into debt over points

No points are worth suffering from the atrocious interest rates on credit cards. Whatever you do, do NOT carry a balance! This excludes particular people with good handles on leverage, but anytime you rack up interest you are cutting right back into your point profits and likely going in the red.

Take advantage of welcome bonuses

Welcome bonuses are critical to earning from rewards programs. Line up your big purchases with a new card to earn big.

Stack points

Use your best food-to-points credit card to plug into your Chick-fil-A rewards program. Use your favorite flight card for Regal Unlimited — find as many ways as you can to stack your favorite cards and programs.

Avoid opening a bunch of credit lines before big purchases

Credit card churning and loyalty programs can mean opening up more lines of credit, which can negatively affect your score. If you’re going to buy a house or car in the near future, you may want to hold off.

Respect the 5/24 rule

While not official, many credit card companies begin to be more cautious with users who open up more than 5 cards in two years (or 24 months), so it’s best practice to stay at or under this split.

Amazing Resources for Credit Card Churning

When you join multiple programs, things can get a bit confusing. Here are some tools and resources that will help you make the most of your programs.

- NerdWallet — one of the best rewards blogs out there

- AwardWallet — track all of your programs and points in one place

- ThePointsGuy — amazing blog for travel point optimization

The Best Loyalty Program is a Universal Loyalty Program

The new era of loyalty programs has arrived

Imagine an internet where every single online transaction, across any brand, in any store, earns you a single type of reward currency that you can spend on more products, or trade for other global currencies (including dollars).

That is the future of loyalty programs. A world where the myriad of points, miles, cashback dollars, and rewards dissolves into a single reward currency that everyone is familiar with. One wallet, one currency, across an unlimited number of brands.

Brands will still be able to create their own unique incentives founded in this currency. And users can earn more whenever they want by engaging in specific actions encouraged by brands, like voluntarily engaging with ads or giving a company more information about themselves.

So if you’re a user who wants to get paid for your data, or a brand looking to add in the ASK cryptocurrency to your incentives, now is the time.

Earn Cryptocurrency Watching Videos (5 Legit Ways)

The world of cryptocurrency is a bit like the Wild West. There are rumors, a lot happening underground, and occasional but increasing government interest. People are looking for gold, and companies are looking to sell the shovels.

The result is a regulatory haze and technical fog that hangs over crypto, making it a bit difficult to figure out how to earn crypto easily and reliably. We get it, and that’s why we’ve taken the time to compile a list of sound ways to earn crypto by watching videos. Those videos are usually ads, but there are some interesting projects that go beyond advertising as well.

What makes a good cryptocurrency earning app?

Here’s what we were thinking through when making our choices.

- Reliable payouts

- Good UX/UI

- Good earning potential

Crypto is a rapidly evolving space, and new opportunities appear all of the time. So while we do stand by this list, it’s a good idea to keep a pulse on the crypto world through the news and social media to identify new opportunities as they arise.

And here are the most legitimate ways we’ve found to earn cryptocurrency by watching videos:

Coinbase Learning Center

Coinbase is one of crypto’s most widely used and trusted crypto exchanges. One aspect of their onboarding is the opportunity to earn crypto by learning about individual crypto currencies through their course videos. You get paid in the relevant cryptocurrency and can have it deposited directly into your coinbase wallet, at which point you can transfer or do whatever you want with it.

Their video courses cover a variety of cryptocurrencies including:

- Clover Finance

- The Graph

- BarnBridge

- AMP

- Stellar Lumens

- Compound

- Balancer

- Ampleforth Governance Token

And many more.

You can earn more than $50+ in various cryptocurrencies, so the payout is really good, but it’s ultimately a finite source. There are only so many videos, so you take a few hours, get your crypto, and get out.

If you’re new to crypto, the education is worth watching either way. It’s a complicated sector, and starting slowly and with an education-first mindset is the best way to prevent poor investments.

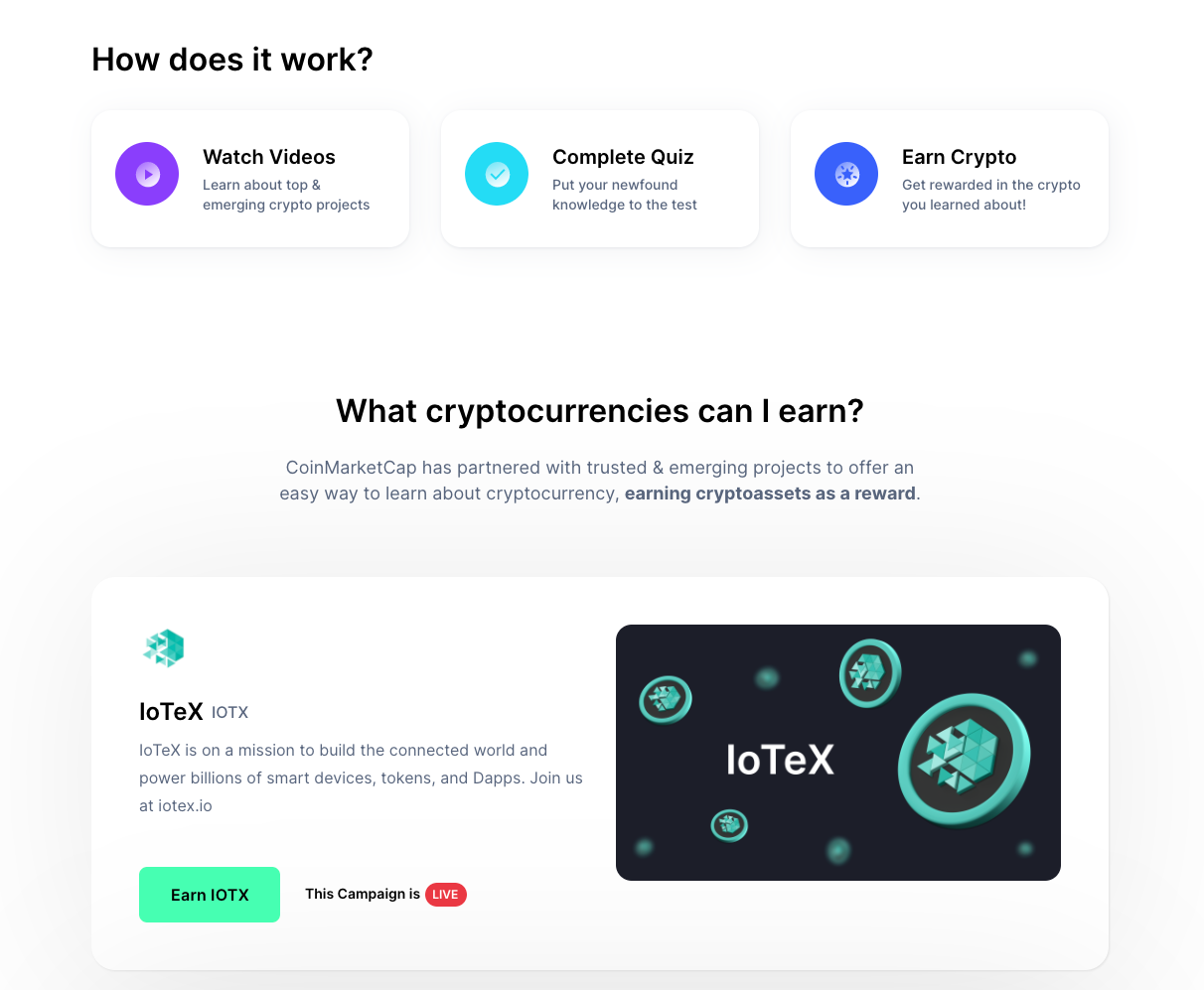

Coinmarket Cap Learning Center

Another option that functions in a similar way to Coinbase is the Coinmarket Cap Learning Center. Coinmarketcap has different videos and requires you to take a short quiz afterward, but the payouts and educational value are also high.

Here are some of the courses they offer:

- Toko Token

- IoTex

- SushiSwap

- Polkastarter

- Plasma Finance

As you’re going through these, try and see which tokens you think have the most potential. These courses are essentially ads and pitches, after all. If one seems particularly promising, you could bankall of the coins you earn from these courses and trade them for the one or few cryptocurrencies you think are most promising.

Try CoinmarketCap Learning Center

Odysee

Odysee is positioned as an answer to Youtube’s and other major information platforms’ censorship and aims to be a decentralized educational and content resource.

Creators can post their videos on Odysee without any fear of censorship, and users can earn LBRY, their token, by watching and interacting with videos. When you watch a video on Odysee, both you and the creator earn crypto. This rewards you for your data and engagement while encouraging creators to continue to release videos on Odysee.

Whether or not earning cryptocurrency on Odysee is worth your time partly depends on if you believe in the LBRY crypto itself.

This is their mission:

First and foremost, LBRY is a new protocol that allows anyone to build apps that interact with digital content on the LBRY network. Apps built using the protocol allow creators to upload their work to the LBRY network of hosts (like BitTorrent), to set a price per stream or download (like iTunes) or give it away for free (like YouTube without ads). The work you publish could be videos, audio files, documents, or any other type of file.

If you think something like LBRY could compete with (or work alongside) a service like Spotify to enable artists to earn more from their music, this could be an interesting choice.

Permission

Permission.’s mission is to give data ownership back to the people. Broadly speaking, this means rewarding you with crypto for any online interaction that involves your data. It’s your data, after all, and if companies want to use it, they should pay you for it.

We’re just getting started with our Web 3.0 revolution, but one example of our mission in practice is our Permission.io browser extension.

The Permission.io browser extension helps you earn cryptocurrency as you surf the web. After you install the extension on Chrome, if you search for something and a relevant video ad is available, we notify you of the option to earn for interacting with that video.

For example, if you were into skateboarding and typed “new skateboards,” and a rewarded ad featuring a skateboarding apparel or board company is available, you could be notified with a video ad that essentially says, “Hey we make skateboards. Wanna check it out?” And then if you do, you earn $ASK crypto for watching the video and even more if you end up buying the board from them.

And the best part? You don’t have to change any of your existing habits. They’re non-intrusive, opt-in ads.

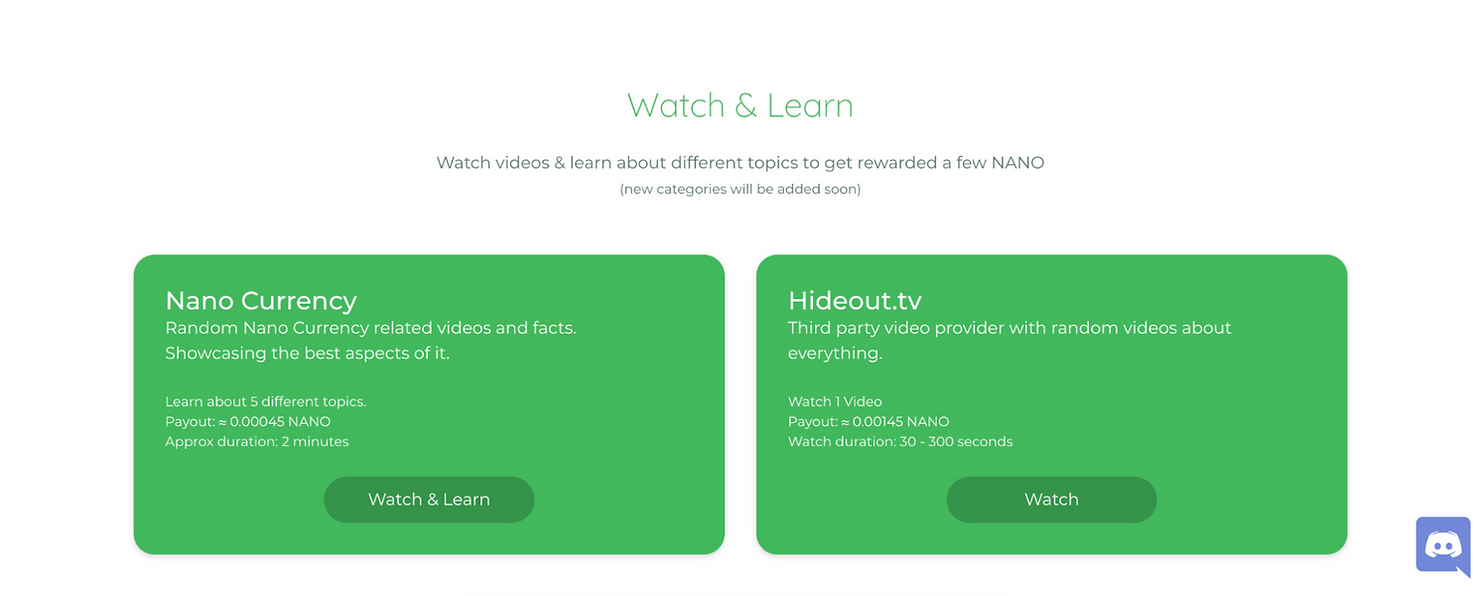

PlayNano Online

While somewhat polarizing due to its price and relationship to the BitGrail $195 Million hack, the Nano community is vibrant, enthusiastic, and has created many ways to earn Nano.

Nano is aimed at being a decentralized currency and hopes to eliminate middlemen that charge transaction fees and tack on other hidden costs. Imagine instant wire transfers between countries for free — that’s the type of world Nano is aiming to build.

PlayNano, specifically, is a project that lets you earn Nano by watching videos, playing games, completing surveys, and other activities.

Like the other options here, it depends on how much you believe in Nano, but if you do, then this is definitely a good option.

The bottom line on earning cryptocurrency by watching videos

With the exclusion of a few companies like the online exchange courses and Permission.io browser extension, earning cryptocurrency by watching videos isn’t a smooth landscape yet. Most of the payouts are very low, and you are still subject to the whims of the crypto market.

These are the best options we know of, but you should still do your research, see which cryptocurrencies you think have the best chance of succeeding, and spend your time watching videos that let you earn those currencies.

The 5 Best Bitcoin Earning Apps of 2021

BTC is the most popular cryptocurrency in the world, and while you won’t earn a ton from these apps, if you find some that fit into your existing habits and the price of bitcoin continues to rise, then they may be worth your time.

What Makes a Good Bitcoin Earning App?

When thinking through what makes the ideal bitcoin earning app, we focused on these criteria:

- Trustworthy and transparent. There’s a lot of fraud and abuse in the crypto space, so knowing that there is a legitimate business behind the app is important.

- Low payout floors. You don’t want to have to wait forever for a payout, so the lower the floor to cash out, the better.

- Good UX and UI. Apps like these need to be easy to use and enjoyable. The payouts are so low that there’s no room for frustration or wasted time.

- Reliable payouts. Nothing matters if you can’t actually get paid after you’ve put the time in. All of these apps have reliable cash-out options.

- Active community. An active community plays into trust and ensures that the company will continue to be incentivized to improve the app and accompanying services.

With that in mind, here’s a shortlist of our favorites separated by category, and we have longer explanations farther down.

The Best Bitcoin Earning Apps

- StormX for shopping

- FeaturePoints for surveys

- Alien Run for getting addicted to earning

- Bling’s Bitcoin Games for general gaming

- BitforTip for answering questions

And here’s a bit more detail on each of these apps. Each of these are available on iOS and Android, and as you go through this list, try and see which ones you can fit into your existing habits.

1. StormX: Best Bitcoin Earning App for Shopping

StormX takes the familiar online cashback model where brands give the referral company cuts of the sales and then that company gives you (the buyer) some of that split and augments it with cryptocurrency payouts.

With StormX, you can earn by shopping on their 750+ partner store, getting anywhere from 0.5% to 87.5% back in crypto. They work with legitimate stores as well, including Lego, Sega, Doordash, Samsung, Microsoft, and more.

You can also earn more crypto by HODLing your crypto in their membership program, playing games, and filling out surveys. Then, you can cash out with Bitcoin, Ethereum, or STorm.

StormX is best for people who already do a good amount of online shopping. For example, if you have kids who love LEGOs and games, you could do all of your Christmas shopping through StormX and get a free crypto kickback.

2. FeaturePoints: Best Bitcoin Earning App for Surveys

FeaturePoints pitches itself as the solution to earning from your downtime. A.k.a. those minutes when you’re stuck in line or bored at the doctor’s office. While surveys are the main way people earn on this app, you can also shop with partners, download free apps, and watch videos — all of which can be turned into cashback via PayPal, gift cards at specific retailers, or turned into Bitcoin.

They also have a cool referral program where you earn from every friend that signs up and continue earning every time they earn — for life.

If you find yourself running a lot of errands or don’t mind filling out a quick survey when pinged by a notification, then FeaturePoints could be good for you. I wouldn’t set aside specific hours to invest into FeaturePoints since the payouts are so low, but if you casually answer questions every few months or so you may be able to cash out a few bucks into Bitcoin.

3. Alien Run: Best Bitcoin Earning App for Addictive Gaming

If you like to game and wouldn’t mind a small amount of Bitcoin to go with that time, then check out Alien Run. It’s a genuinely fun game with a good mix of easy and difficult levels, and new missions are released daily.

The app has a lot of ads, though, and the payouts, like all of these apps, are low. So if you already game and genuinely enjoy Alien Run, then sure, why not, but if you’re downloading Alien Run only to earn Bitcoin, then you have better options.

4. Bling Games: Best Bitcoin App for General Gaming

Bling is a game developer that has a variety of simple games you can play to earn Bitcoin including Bitcoin Blast, Bitcoin Blocks, Bitcoin Food Fight, and more. You create one central account that is linked to all of their games and collectively earn while playing. The games are well-built and have fun multiplayer options, but you have to watch an ad after every game and the payouts are low.

Our advice is similar to Alien Run. If you already play games like solitaire, Candy Crush, or 2048, then you’ll probably enjoy these Bitcoin games, and swapping your play time to one that earns you a small amount of Bitcoin could be worth it.

5. Bitfortip: Best Bitcoin App for Being Helpful

Bitfortip definitely needs work and is hit by a lot of spammers, but we’re including it because there’s still an active community and it’s an interesting idea. You can think of BitforTip like Quora but you’re paid for your answers with small amounts of BitCoin.

For example, you may hop on the site and see that someone asked: “How easy is it to replace spark plugs in a Honda Civic?” along with an attached BTC reward amount. If you have mechanical expertise and could answer it, you can “win” the associated BTC tip for that question.

Bonus: The “Earn While Your Browse” App

Permission’s Browser Extension helps you earn $ASK crypto for browsing and engaging with relevant brands online.

For example, let’s say you’re into building gaming computers, and you’re looking for a new solid-state drive. If you search for a SSD and one of our partners has one they think you would like, your extension will ping you with the option to watch a relevant ad. If you choose to do that, then you’ll instantly earn the displayed amount of $ASK. And then, if you dig the SSD and buy it, you’ll get an even larger $ASK payout. Plus, if you’d prefer to own BTC instead of $ASK, you can choose to trade it for bitcoin on an exchange.

And this browser extension is just the beginning. Permission’s browser extension is part of our mission to take back data ownership from the internet barons and help users all over the world start earning from the data. If you think you should earn for the data you’re already giving away for free, then you should join us and start earning $ASK.

What You Need to Know About Bitcoin Earning Apps

The unfortunate truth to bitcoin earning apps is that the payouts are extremely low.

With the exception of the Permission browser extension, all of the apps we found pay such small amounts, often amounting to fractions of a cent or minuscule amounts of Bitcoin (typically Satoshi), that the time you spend on these apps can almost always be better spent doing something else that would allow you to buy even more bitcoin.

For example, instead of spending 5 hours a week getting pennies on the dollar on these apps, you could teach a skill online, collect recyclables, sell baked goods, or do any other number of small side hustles that you could directly invest into Bitcoin instead. If saving or investing is your goal, this would be a much more effective route.

Your best bet is to fit these apps into your existing life instead of spending what feels like “extra time” on them. Gaming when you’re stuck in line, completing surveys in doctor’s offices, and answering questions when you’re bored are good examples of this.

Then, every few months or so you’ll have a few bucks you can put toward your BTC balance.

Earn Crypto Without Changing Your Habits

Why aren’t you already earning for the data you’re giving away with every move you make online?

Surf the web like normal and earn crypto along the way. With Permission’s Browser Extension, earning from your data is finally easy.

Apps Like Honey: 6 Honey Alternatives To Try In 2021

Shopping online has come a long way, and when it comes to saving money online, you’ve got plenty of options. Honey is one of the most popular coupon browser extensions on the internet, but it is far from the only one. There are tons of services you can try, each with their own spin.

To save you some time figuring out which one is best for you, we’ve compiled a list of 6 other money-saving apps like Honey, along with some ideas on how to make the most of these apps.

We’ll start with a reminder of what Honey does and then get into our favorite alternatives.

What Is Honey?

Honey is a plugin for all major browsers that helps users save money while online shopping by automatically searching and applying any relevant coupon codes when checking out.

When you have the extension installed, you receive notifications during the checkout phase on any eligible store. If you hit accept, Honey will automatically search their massive database of online coupons and apply the best one. They also have coupon codes and exclusive deals that can be used to earn “Honey Gold,” which are points you accrue over time and can be redeemed for gift cards.

To be clear: Honey is a great extension, but people have reported bugs and sometimes take issue with the data it collects (which is something probably all of these extensions do), so having other options means you can either use a combination and/or find one that is better suited to your needs.

How to Choose the Best Coupon Browser Extension

Once you dig into the world of cost-saving extensions and apps, one thing becomes clear: most of these apps function and behave very similarly.

With that in mind, the best choice is actually a combination. Because these extensions and apps cover different retailers and strike timed deals with stores, the best deals can change at any point. For example, some may be better for finding deals on clothing than on software or for getting more back-to-school deals in August, etc.

That being said, if you’re prioritizing cashback opportunities, it may be best to invest more in a single platform instead of spreading out your earnings across multiple services. Diversifying too much can increase the amount of work it takes to earn & may hold you back from crossing different redemption thresholds (some apps won’t let you cash out until you earn a certain amount).

And finally, if you’re using these extensions as an exercise in budgeting, remember that these apps exist to get you to buy more. It may seem like you’re saving cash, but if you just end up shopping more than you used to, then it’s a net negative. If you aren’t concerned with that and are comfortable building them into your existing shopping habits, then they can be fantastic.

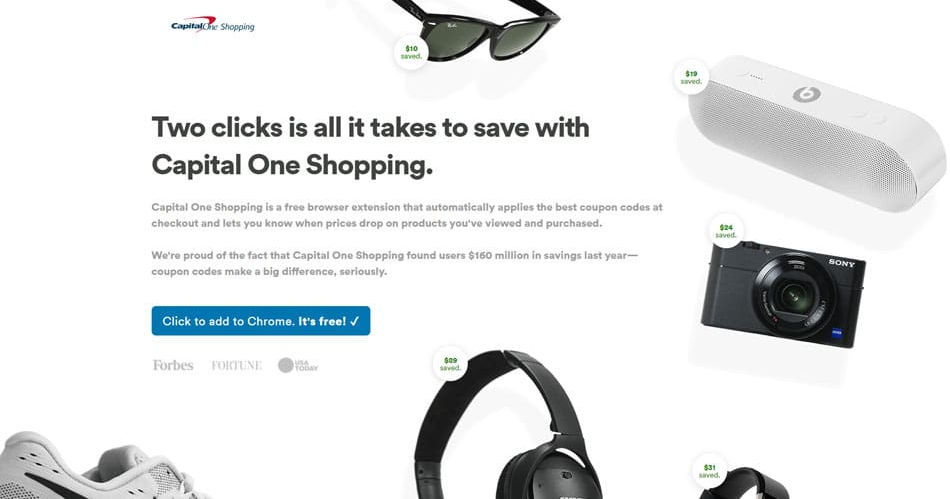

1. Capital One Shopping (formerly WikiBuy)

Capital One Shopping, which used to be Wikibuy, is the most direct competitor to Honey. They provide almost the same experience, with automatically applied coupon codes, price alerts, and more.

How Capital One Shopping Works

Capital One Shopping helps you shop online, which in turn lets Capital One get more transaction fees and collect useful data about you. Anytime you’re looking at products online, the extension will search thousands of other retailers to see if there are any other places you could buy it for cheaper and/or if a coupon code is applicable.

You’ve got options with Capital One Shopping, too. You can download the browser extension and get a lot of value from it, but you can go even deeper by picking up the mobile app as well. This lets you get mobile alerts on shopping deals and check if there are deals on in-store items as well.

Pros of Capital One Shopping

- Free

- Easy-to-use browser extension

- Trending deals and featured offers

- Shopping credit for shopping like normal

- Price drop alerts on products you want

- Mobile app can check in-store items as well

- Automatically applies coupon codes during checkout like Honey

- Backed by an active and large company, which usually means faster bug fixes and more deals.

Cons of Capital One Shopping

- Mobile app user experience isn’t great but is improving.

- They collect a lot of private information about you.

Where to Download

Download Capital One Shopping here.

2. Rakuten

Rakuten is incredibly popular, and it’s no surprise why. This one-stop-shop service works with retailers to bring you exclusive cashback deals, negotiates coupon deals for its members, and has partnerships with thousands of retailers from Amazon to Target.

How it Rakuten Works

Rakuten gets a kickback for every purchasing user they send to retailers, and then they share that kickback with you. You become eligible for these cashbacks by clicking from Rakuten into whatever retailer you’re shopping from.

The typical user experience with Rakuten involves seeing an extension notification and clicking through it to earn from it OR getting in the habit of going directly to Rakuten’s site to see if there are deals on items you’re thinking about buying. For example, if you know you’re looking to grab a Nintendo Switch for your nephew this Christmas, you could go to Rakuten with that in mind to see if there are any relevant kickbacks.

Pros of Rakuten

- Free

- Earn anywhere from 1-40% cashback on almost anything purchased through Rakuten.

- Thousands of retailers

- Get paid out in cash

- In-store earning opportunities

- Easy browser extension

- Mobile app

Cons of Rakuten

- Quarterly payouts

- Sometimes the best products at retailers aren’t eligible for cashback.

- Have to get in the habit of going from their site or extension to a retailer.

Where to Download

Download Rakuten here.

3. Karma (formerly Shoptagr)

Karma is another extension and app you can use to get price drop alerts, automatically apply coupons, make wishlists, and organize future purchases.

How Karma Works

The secret to Karma’s success is in their tech — their predictive analytics bot helps consumers make better shopping decisions prior to purchase, whether by opting for a better price, applying coupons, or letting you know to wait until the price drops even more[*].

The best way to use Karma is to set up what you know you’d like to buy in advance and then wait as price drop alerts roll in. For any of you out there who like to start shopping for actual Christmas after Christmas in July, then this is right up your alley. You can set up your wishlist, organize your future purchases by category, and wait for that ping. Then you’ll know it’s the best time to pick it up!

Pro Tip: combine these alerts with CamelCamelCamel’s Amazon price history (alternative #6 in this list) to see if the deal is as good as Karma is saying it is.

Pros of Karma

- Free

- Wishlist for out-of-stock items

- Price drop alerts

- Organize future purchases by category

- Coupons automatically applied

- Extension works on Chrome, Mozilla, and Safari

- Pays out in PayPal

- Mobile app

Cons of Karma

- Not as many stores as other options

- App and extension can be a bit buggy.

- Sometimes the best products at retailers aren’t eligible for cashback.

Where to Download

Download Karma here.

4. Piggy

Piggy focuses exclusively on cashback opportunities from partner retailers. While it doesn’t have the resources and depth some of the other options listed have, it can still be useful to have in your cashback mix.

How Piggy Works

By acting as a highway hub for shopping traffic, piggy can cash in on affiliate relationships and pass some of that cash back to you. All you have to do is download the extension and wait to get pinged as you shop. If you do, then you have the option of buying through Piggy and earning cash back.

Pros of Piggy

- Free

- Convenient browser extension

- Automatic coupons

- Get paid via check.

Cons of Piggy

- $25 cash out floor.

- Not as many retailers as other options.

- Not well designed.

Where to Download

Download Piggy here.

5. RetailMeNot

While RetailMeNot doesn’t have as many retailers as Capital One or Rakuten, they get their own exclusive deals and opportunities that are definitely worth keeping an eye on. They also release their own buying guides and offer advice on how to get the most out of your experience.

How RetailMeNot Works

Similar to Rakuten, RetailMeNot is best to use with a plan in mind. Apart from the extension, your best bet is to subscribe to RetailMeNot’s newsletter and check their website out periodically for any exclusive offers.

Once you see something that’s on your “dream” or “to-buy” list, you can snatch it up while the offer is good. Alternatively, you can just go to RetailMeNot to see if anything on sale catches your eye!

Pros of RetailMeNot

- Free

- Automatically applied coupons

- Exclusive deals

- Mobile app

Cons of RetailMeNot

- Only supported on Chrome

- Not as many retailers as some other options

- Site design isn’t as sharp

Where to Download

Download RetailMeNot here.

6. The Camelizer

The Camelizer is the browser extension for long-time Amazon price tracker CamelCamelCamel, and it’s a fantastic resource for seeing just how good that new “sale” is. For example, if you’re shopping a Summer sale in July, you can see if last year’s prices in the Fall were better than what you’re seeing now.

How The Camelizer Works

CamelCamelCamel is free for any user, and it’s best to use alongside the other options above. Consider CamelCamelCamel your coupon “hype manager.” In other words, it’s the voice of reason when an extension pings you with another AMAZING deal.

Because you can see just how good the deal is by comparing previous prices (assuming it was sold on Amazon), you can know if this is the sale to buy on or if you should wait for the next one. You can get all of that info by just clicking into the Camelizer on any Amazon listing. You can also set up specific price drop alerts on any items you know you want to buy as well.

Pros of The Camelizer

- Free

- Top price drops for best Amazon deals

- Awesome price history graphs

- Good for seeing how good a sale really is

- Works on Chrome, Firefox, Edge, Opera, and Safari

Cons of The Camelizer

- Design isn’t super friendly

- Is exclusive to Amazon

- No cashback or earning potential

Where to Download

Download The Camelizer here.

The Bottom Line on Apps Like Honey

Many of these apps function similarly, and each of them has different exclusive deals and events. So again, the ideal solution is actually a combination. Download a few of these extensions and compare them whenever you’re shopping to see what the lowest price is.

The best thing you can do when using these apps is get in the habit of checking these out before you actually order. In other words, once you know you’re going to buy something, take another 5 minutes and see if you can save some cash through these sites and apps! If you make this a buying habit, you’ll definitely save some dough.

What Is an Ad Blocker: Everything You Need to Know

Wherever you go, you will get bombarded with tons of ads on the internet.

While many of them provide value, the massive amount of advertisements can easily become disturbing for users as they try to enjoy their favorite activities in the digital world.

In fact, some publishers place so many ads in their apps and websites that it prevents users from enjoying the actual content.

Fortunately, using an ad blocker is an excellent way to remain (nearly) advertisement-free on the web.

In this article, we will explore what an ad blocker is, how ad blocking works, its benefits and downsides, as well as the actual methods to prevent advertisers from ruining your online experience.

The Problem With the Current Online Advertising Landscape

Before we dive into our topic, let’s first take a look at the problem ad blockers are meant to solve: the disturbing and intrusive nature of the current online advertising landscape.

Before the age of the internet, people encountered ads mostly in newspapers, on TV, radio, and billboards.

While the average person was exposed to between 500 advertisements a day during the 1970s, this number surged to a daily 5,000 by 2007.

With the rise of digital advertising, we now see an estimated 4,000-10,000 advertisements every day, which can be quite overwhelming.

And it’s no surprise.

It’s super easy for businesses to create, place, and show an ad to internet users by utilizing the advertising platforms of tech giants like Facebook and Google, which dominate the digital ad space.

Interestingly, even though the pandemic caused a huge hit to the online advertising industry, online ad spend still managed to grow by 1.7% in the US in 2020. In fact, Statista predicts worldwide digital advertising revenues to surge from 2019’s $333.8 billion to $491.1 billion by 2025 with a 5.67% Compound Annual Growth Rate (CAGR).

Due to the current nature of the online advertising landscape, consumers have developed strategies and mechanisms to cope with the massive amount of ads they encounter.

Much to the chagrin of advertisers, consumers are interacting with less and less ads, decreasing the return on investment (“ROI”) for advertisers, i.e., making advertising dollars spent less profitable for advertisers.

Consumers can hardly be blamed for wanting to distance themselves from online ads; indeed, they face numerous issues with the current state of digital advertising, including:

- Disturbing user experience: Imagine being bombarded by ads while reading this article with banners placed on the sides, the top, and the bottom of the page, as well as after every second or third paragraph. And, to make it extra annoying, imagine having to avoid the dreaded pop-up, which websites increasingly use despite the fact that pop-ups irritate about 73% of internet users, according to a HubSpot survey.

- Interrupting primary activities: In addition to being annoying, some ads even interrupt internet users’ primary activities. Take YouTube ads before videos or promotions in smartphone games as examples, which keep consumers waiting before they can access the publishers’ content.

- Slowdowns and battery drainage: While trackers and banners are being loaded, large numbers of unoptimized ads can appear and take their toll on applications’ and websites’ performance. According to an Opera study, a website is 51% slower on average when ads are displayed than with blocked advertisements. In addition to performance issues, the firm revealed that ads can also drain the battery life of devices by nearly 13%.

- Security concerns: In the past few years, malvertising has become a real issue for internet users. Malvertising refers to spreading malware and viruses via online advertising and was responsible for roughly 1% of the ad impressions in May 2019. In addition to infecting user devices, cybercriminals also use digital advertising to attract victims with fraudulent schemes.

- Lack of privacy: Have you ever visited an ecommerce store without making a purchase just to later encounter the same business’ ads on social media? Besides advertisements, most websites and platforms on the internet use web trackers to collect, store, and share data about the visitors’ online activities. As a result of exchanging user information with third parties, advertising networks know everything about you, diminishing your privacy on the web.

What Is an Ad Blocker?

An ad blocker is a software solution capable of preventing advertisements from showing for the user while browsing the web or utilizing an application.

Contrary to their name, most ad blockers do not actually block advertisements. Instead, they stop ads from downloading on your browser by disabling requests that include advertising-related content.

As a result, users can enjoy a mostly ad-free experience with enhanced security, privacy, and device performance without being exposed to intrusive content.

How Do Ad Blockers Work?

Ad blocking software solutions use simple filter lists containing URLs to identify and block advertisement-related content on websites and applications.

In web browsers, ad blockers work in the following way:

- Upon visiting a website, the ad blocker checks its filter list to see whether the site is included.

- If the search returns positive results, the ad blocking software blocks requests to external content, which prevents the advertisement from getting downloaded and shown on the page.

Instead of completely disabling the request, other ad blocking services replace the advertising content with something else after identifying it.

No matter the method used to disable advertisements, filter lists play a key role in the ad blocking process.

For that reason, filter lists are regularly maintained and updated by both the creators and third-party communities independent of the developers.

Most ad blockers allow users to whitelist the ads of different websites, services, and applications. By doing so, they can support the creators, prevent possible ad blocking-related page issues, or unlock the content of publishers that use ad block walls.

Many ad blockers provide protection against all kinds of intrusive content, such as advertisements, malware, and web trackers, across many applications, web browsers, and devices.

At the same time, some ad blocking software solutions can only disable unwanted content in specific apps and devices.

How Do Ad Blockers Make Money?

Not all ad blockers are created equal, as some are more effective in providing a distraction-free experience to users than others.

An excellent way to determine an ad blocking solution’s efficiency is by examining the service provider’s business model.

Ad blockers can make money in multiple ways, with the most popular methods including:

- Free: Some ad blockers function as open-source apps that are available to users for free. While they are maintained by the community, free solutions often finance their development via donations. A good example of this business model is uBlock Origin. However, strangely enough, the project’s creator doesn’t accept any donations. Instead, the developer decided not to create a dedicated website or a forum for the ad blocker in order to cut the maintenance costs.

- Paid service: Instead of resorting to the community’s help and donations, many ad blocking software solutions offer services in exchange for an upfront payment or a subscription fee.

- Freemium: Freemium is a popular business model among software solutions, and multiple ad blockers use it. Here, users can utilize only a part of the features for free. Optionally, they can pay a one-time or monthly subscription fee to access more powerful ad blocking functions.

- Whitelisting some of the ads: Certain ad blockers use a rather controversial business model. While they offer their services for free to users, the creators whitelist a share of ads that allegedly follow “acceptable” advertising practices. However, some ad blockers offer whitelisting services for advertisers in exchange for a payment or a cut from their ad revenue.

Why Do You Need an Ad Blocker and What Benefits Does it Offer?

An ad blocker is a must-have for those who want to enjoy an advertisement-free experience in the digital space.

Ad blockers offer the following benefits to users:

- Improved user experience: Users can achieve a distraction-and intrusion-free experience on the internet by using an ad blocker to eliminate advertisements. As a result, they can conveniently browse the web or use their favorite apps without worrying about getting bombarded by advertisers’ offers.

- Enhanced security and privacy: Most ad blockers have built-in features to detect, spot, and block malicious and fraudulent ads on the internet. In addition to eliminating malvertising, users can also enjoy increased privacy by disabling web trackers. Furthermore, ad blocking is an excellent way to protect children from inappropriate advertisements on the web.

- Faster page load times: Ad blockers can improve browsing speed and application performance by getting rid of bloated and unoptimized ads. While users have access to a more seamless experience, businesses can also benefit from the lower bounce rates achieved via faster page load times.

- Optimized battery life and mobile data usage: As ads take a heavy toll on device batteries, preventing them from loading can save energy and achieve better runtimes. The lack of ads can also reduce the mobile data usage of consumers.

- Potential savings on impulse shopping: By eliminating ads, the number of offers internet users encounter will significantly decrease. They can take advantage of this to reduce their unnecessary expenses, refrain from impulse purchases, increase their savings, and limit their chances of getting targeted by fraudulent companies.

What Are the Possible Downsides and Limitations of Ad Blocking?

As with every software, ad blockers have some limitations and downsides, such as:

- Broken content: Since ad blockers disable all advertising and tracking-related content of a website, it can lead to an unwanted experience on some occasions. When the app blocks an important request, the site may display broken content to the user.

- Inability to access content: As some publishers still utilize ad block walls, refusing to disable ad blocking software can prevent users from accessing certain apps and websites.

- Can’t block all ads: Unfortunately, although they can block most advertisements, ad blockers can’t provide a fully ad-free experience to users. Furthermore, the number of unblocked advertisements increases for ad blockers that adopt the whitelisting business model.

- Lack of support for content creators: Some content creators use digital advertising exclusively to monetize their solutions. Using an ad blocker without whitelisting them could reduce their revenue and limit their growth.

How Does Ad Blocking Impact Publishers and Advertisers?

According to Statista, ad blocking penetration was expected to surge from 2014’s 15.7% to 27% by 2021 in the United States.

In fact, ad blocking solutions were adopted much faster, with the technology’s penetration reaching 27% by February 2018 among US users.

Since many users are blocking ads on their devices, it has a major impact on advertising networks and businesses.

The good news for advertisers is that they don’t have to pay a dime for advertisements targeting ad block users (as they don’t get shown at all).

However, as a significant share of consumers have opted out of receiving ads from advertisers on the internet, this also means that businesses have a smaller audience to target.

At the same time, publishers are hit harder by ad blocking tech as a part of their visitors won’t interact with the ads displayed on their platforms, causing a revenue loss for the firms.

However, ad blocking impacts giant digital advertising networks (e.g., Facebook Ads, Google Ads) the most.

The more users install ad blockers, the fewer impressions and interactions advertisements get, decreasing the revenue networks make by connecting publishers and advertisers.

Countermeasures From Publishers

As ad blocking means a significant threat to the digital advertising industry’s current state, many publishers and networks have decided to take steps against ad blocker solutions.

One of the most popular ways publishers have used to reclaim their lost revenue is automatically detecting ad blockers upon user website visits.

When an ad blocker is detected, a publisher may decide to display a message to the user to convince him to disable the software.

However, others have taken a more harsh stance by installing an ad block wall that denies access to the site’s content until the user disables its ad blocking software.

While the latter method seemed to work initially, researchers discovered that 74% of users would leave a website with an ad block wall set up.

Due to these methods’ lack of success, businesses have joined initiatives like Acceptable Ads and the Coalition for Better Ads that require both publishers and advertisers to apply a variety of pro-consumer and user-friendly digital advertising standards.

By showing only heavily optimized ads to users, publishers of these initiatives can get their advertisements whitelisted as ad blockers participating in the programs.

What Are the Best Methods to Block Ads?

In this section, we have collected the best methods you can use to block ads in the digital world.

Let’s see them!

1. Browser Extensions

Examples: uBlock Origin, Adblock Plus, AdBlock

One of the most popular ways to block ads is by installing the software via a browser extension.

Here, the user visits its browser’s add-on store and sets up the ad blocker as a free extension.

Upon successful installation, the ad block browser extension will screen content for trackers, advertisements, and malware. After applying the filter lists, the ad blocker tells the browser whether to allow or disable an element.

Based on the rules the solution uses, it can leave whitespace where the ad would be normally displayed, replace it with other content, or just simply hide the element.

As a result, users can get rid of most ads while surfing the web via the browser where the ad blocker extension is installed.

On the other hand, since it’s a browser extension, the ad blocker doesn’t have access and can’t block unwanted content in other apps installed on the device.

2. Ad Block Browsers

Examples: Opera, Brave, Firefox Focus

Ad block browsers are internet browsers with built-in ad blocking capabilities.

They work very similarly to ad block browser extensions as they can effectively disable advertisements on the web.

While users don’t have to worry much about installing an extension to eliminate ads, browsers with built-in ad blocking features are often well-optimized and feature better performance than extensions.

It’s also important to mention privacy browsers. Instead of blocking ads, these solutions disable web trackers to ensure a high privacy level for users.

3. Mobile Ad Blockers

Examples: Wipr, 1Blocker, Blokada, AdAway

According to Statcounter, mobile devices have accounted for 55% of the internet traffic compared to desktop’s 45% in April 2023.

With smartphone devices taking the lead, it shouldn’t come as a surprise that mobile ad blocking has become popular among users.

In fact, while desktop was standing at 236 million, active mobile ad block users grew to 527 million by Q4 2019, according to PageFair’s 2020 AdBlock Report.

In addition to the web, mobile users encounter many ads within the apps they have installed on their devices.

For that reason, they can install an ad blocker for iOS or Android to disable ads both on the web and in applications.

As a side note, since browsers do not support extensions on some mobile devices, ad block browsers have become increasingly popular on smartphones.

If you want to learn more about mobile ad blocking, we recommend taking a look at the following Permission.io articles where we compared the best iOS and Android ad blockers.

4. Cross-Device Ad Blockers

Some ad blocking solutions offer protection against advertisements across multiple devices.

As a result, users can access apps and browser extensions on desktops, tablets, and smartphones to get rid of unwanted content with a single solution.

With a package of apps and browser extensions, cross-device ad blockers utilize various methods to eliminate advertisements.

On the flip side, cross-device ad blocking support is often a paid service without the option to access the service for free.

5. DNS Filtering

Examples: AdGuard DNS, DNSCloak

An effective method to block advertisements is via DNS filtering.

DNS stands for the Domain Name System that is responsible for matching domain names with IP addresses, allowing users to access content on the web without remembering the technical details and a confusing list of numbers.

The process works similarly to calling a friend. Instead of memorizing his number every time, you have it saved in your smartphone contacts so you can call him with a single tap. This is the exact reason why the DNS is often referred to as the “address book” of the internet.

With DNS filtering, the user connects to a DNS server configured to block access to either IP addresses or domain names seeking to display ads to the user. In addition to advertisements, DNS filtering also protects users from web trackers and malicious content.

When an app or a website sends an unwanted request, the modified DNS server refuses to reply with an IP address and instead sends a null response.

Similarly to browser extension-based ad blockers, the DNS filtering method also uses blocklists to identify and disable undesirable content. For that reason, the service provider must update the filter lists often to prevent advertisers from bypassing the DNS server.

Since DNS filtering blocks all unwanted requests coming from the web, this method can effectively provide system-wide protection against ads to internet users.

6. VPN

Virtual Private Networks (VPNs) are popular tools that allow users to disguise their online identity and encrypt their internet traffic.

To achieve that, the network redirects the user’s IP address through a configured remote server operated by a VPN host.

As a result, the VPN server becomes the source of the user’s data, helping to hide the data he or she sends or receives online from Internet Service Providers (ISPs) and other third-parties.

Since VPNs allow users to connect to servers in numerous countries and locations, they can use such solutions to bypass geo-blocks and access regional content on the web.

In addition to all the above, multiple VPN solutions feature built-in ad blocking to eliminate malware, trackers, and online advertisements.

While this method works similarly to DNS filtering, VPN ad blockers offer a one-stop solution to eliminating unwanted content and in apps across all devices connected to the user’s network.

However, for ad blocking to work, the user’s devices have to be continuously connected to the VPN network.

For that reason, it’s essential to test the performance of the VPN solution to avoid traffic-related issues and ensure a seamless user experience.

7. Hardware Devices

Examples: Pi-Hole

In the above sections, we have introduced software-based solutions to block advertisements on the web and in applications.

Now let’s examine a method that uses a hardware device for the same purpose.

Currently, the only viable hardware ad blocker on the market is called the Pi-Hole, which uses a Raspberry Pi to block advertisements on the network level.

For that, users have to configure the Raspberry Pi as a Pi-Hole, setting up a local DNS server that filters all content coming through the network and disables requests related to malware, advertisements, or web tracking.

Interestingly, the Pi-Hole replaces any pre-existing DNS server (including the ISP’s) on the user’s network with its own, allowing the device to block ads on devices like smart TVs that software-based ad blockers normally can’t reach.

While Pi-Hole is a free and open-source ad blocking solution, users have to purchase the necessary kit (e.g., a Raspberry Pi or another compatible device) to protect their networks against advertisements.

Also, as users have to manually configure the device to set up a Pi Hole, they have to possess at least minimal technical knowledge.

In terms of ad blocking, Pi Hole’s protection against unwanted content only works when the user is connected to his home private network (or the location where the device is installed to block ads).

Ad Blocking: The Key to a Distraction-Free Internet

Ad blocking is an excellent way to disable annoying advertisements, intrusive trackers, and malicious content. As a result of ad blocking, you can have a seamless, distraction-free experience while browsing the web or using your favorite apps on your device.

Additionally, ad blockers also improve your device’s performance, enhance your privacy and security, as well as limit your data and battery usage.

With that said, consider supporting your favorite content creators by whitelisting their advertisements via such an ad blocking solution.

An Alternative Solution to Preserving Privacy and Security